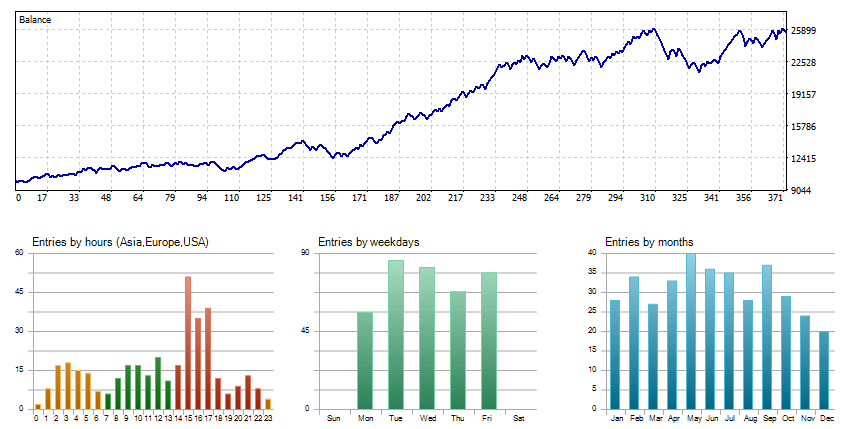

In the realm of trading, success hinges on the delicate balance between aggressive tactics and risk management. The Trade4G Trend Following strategy exemplifies this balance, offering traders a well-crafted approach to capturing market trends while safeguarding their capital. Let’s unravel the layers of this innovative strategy.

The Heart of Trade4G: Donchian Channels

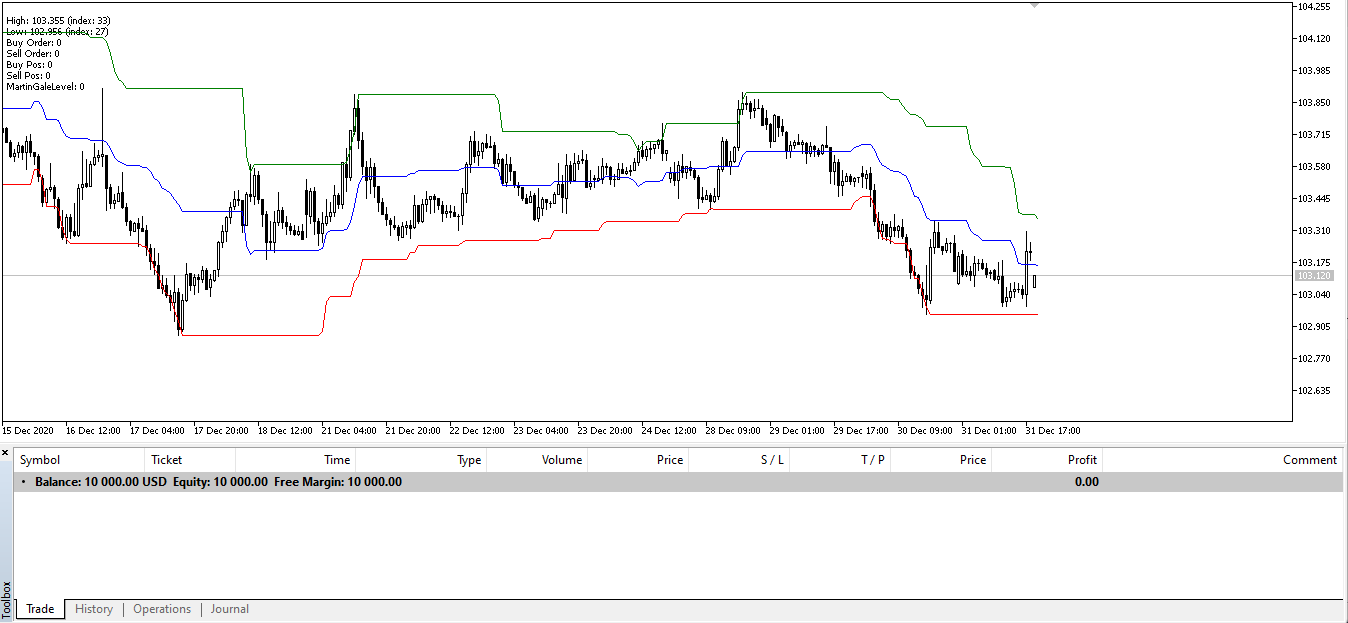

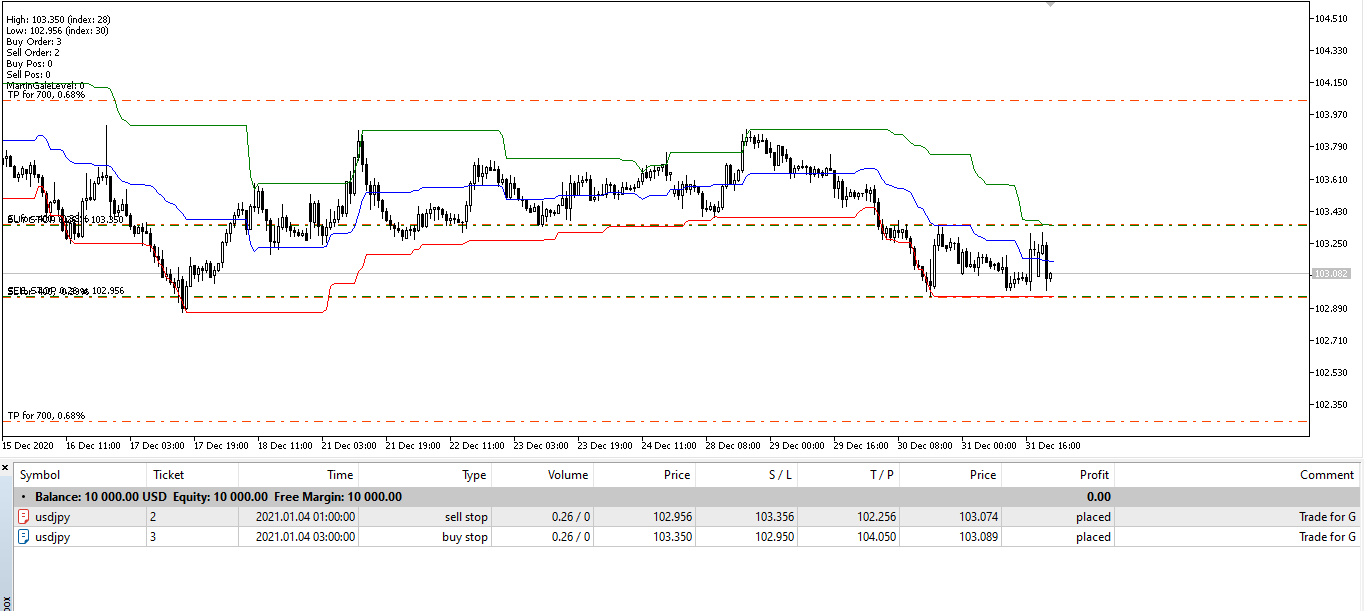

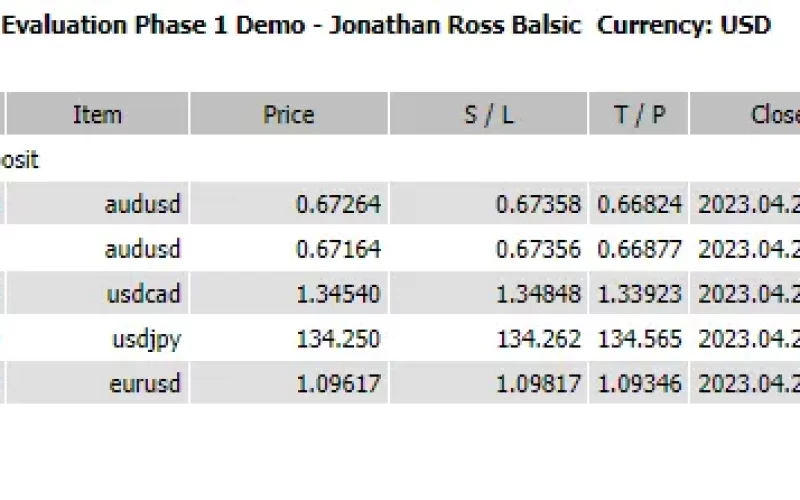

At the core of the Trade4G Trend Following strategy are Donchian Channels, a time-tested tool for identifying market extremes. By setting the stage with the highest and lowest price points over a given period, the Trade4G strategy calculates a median threshold to determine precise entry points for trades. A cross above the median suggests a bullish momentum beckoning a buy order, whereas a dip below calls for a sell.

Strategic Risk Control

What sets Trade4G apart is its unwavering commitment to risk management. The strategy defines explicit stop-loss and take-profit points, ensuring that each trade is cushioned against market volatility. The added layer of a trailing stop-loss acts as a defensive shield, locking in profits by dynamically adjusting to favorable price movements.

The Martingale Twist

Incorporating a tactical twist, the Trade4G strategy employs an optional Martingale component. Should a trade not go as planned, the strategy bravely proposes an increased lot size for the next trade, intensifying the pursuit of recovery. However, this bold move is meticulously capped at a predetermined number of levels to prevent exposure to excessive risk.

Tailored to Your Trading Style

Flexibility is at the forefront of Trade4G, offering a suite of adjustable parameters. Traders can fine-tune lot sizes, profit targets, and stop-loss thresholds to align with their individual trading style and risk tolerance. This customization ensures that the strategy remains relevant and responsive to the user’s unique trading objectives.

Automated Precision

Designed for the MetaTrader platform, Trade4G operates with a level of automation that allows for constant market monitoring. The strategy diligently manages open positions and pending orders, adapting to the ever-evolving market landscape.

Responsiveness to Results

A notable feature of Trade4G is its ability to learn from the past. The strategy records trade results, adjusting the Martingale levels based on performance outcomes. Success resets the level, while a setback prompts a calculated increase, affecting the volume of subsequent trades.

Trade4G Trend Following: A Symphony of Analysis and Intuition

Trade4G Trend Following isn’t just a trading strategy; it’s a comprehensive system that orchestrates technical analysis, risk management, and adaptive tactics into a harmonious pursuit of trading excellence. For the discerning trader who seeks to ride the waves of market trends with confidence and precision, Trade4G offers a path to potential profitability, guided by strategic foresight and prudent risk measures.

In the ever-changing tapestry of financial markets, the Trade4G Trend Following strategy stands as a testament to the power of marrying aggressive trend capture with disciplined risk strategy — a true trader’s companion in the quest for market mastery.