The strategy involves a dynamic trading system that combines classic technical analysis with a risk-managed approach to entering and managing trades in the financial markets. Here’s a summary of how the strategy works:

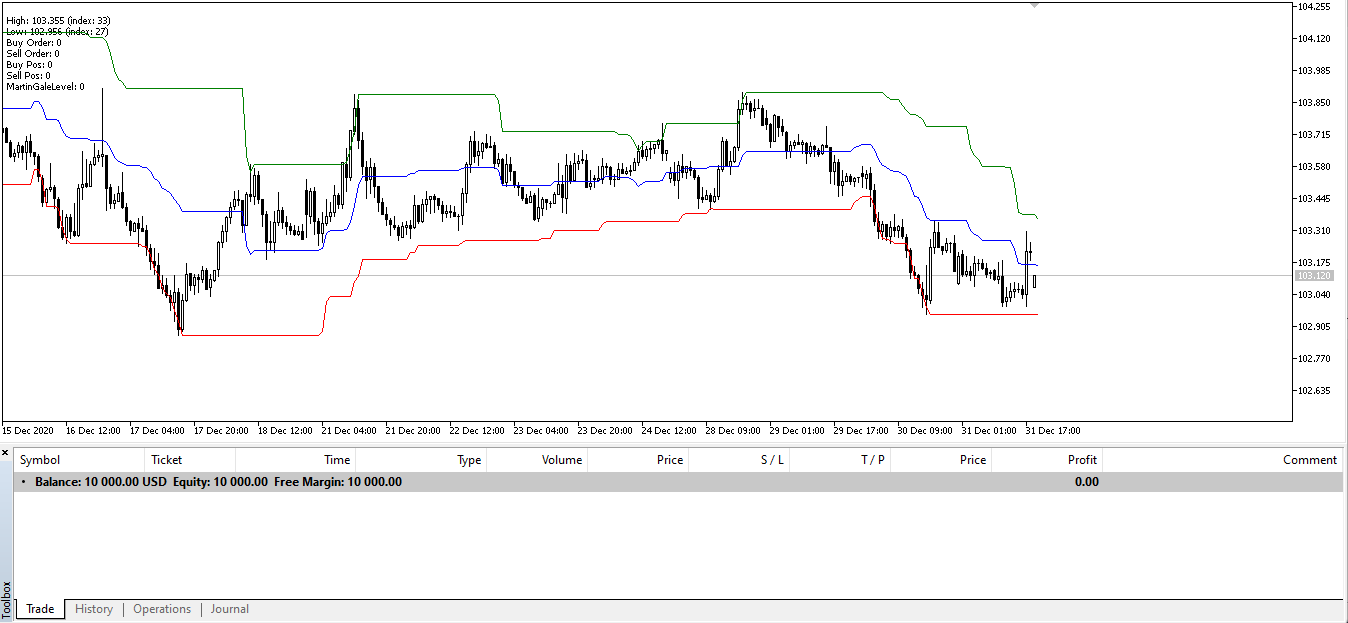

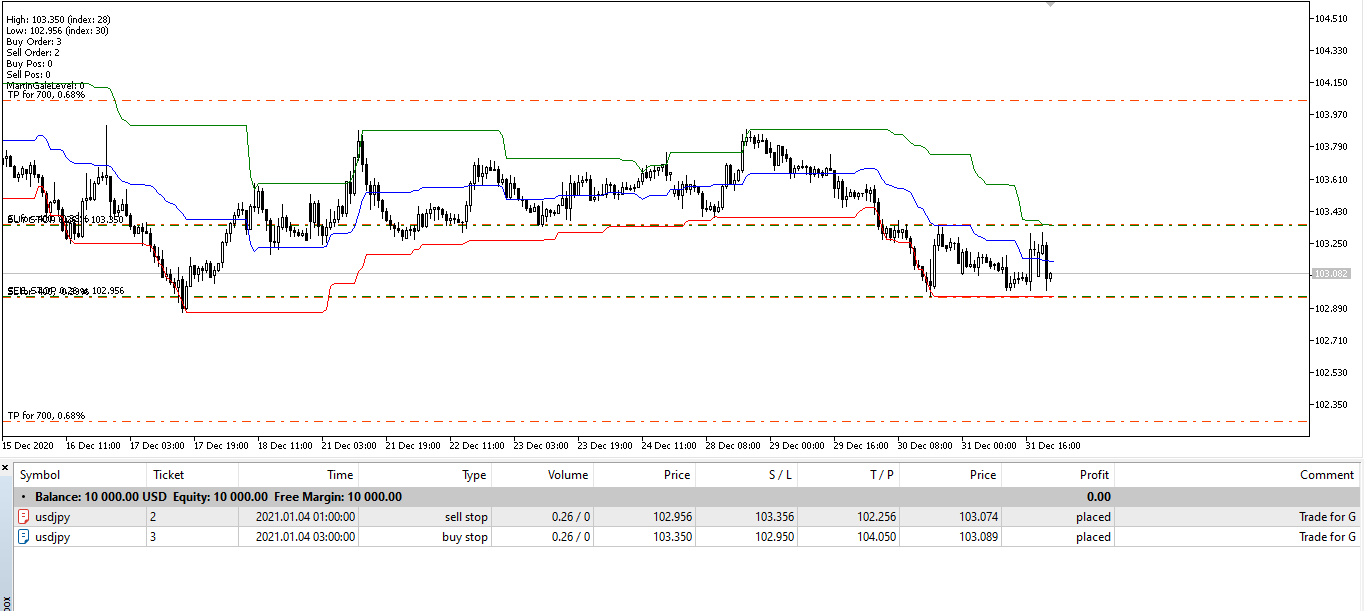

- Base Trading Logic: The trading system uses Donchian Channels to determine market entry points. Specifically, it identifies the highest and lowest prices over a set number of candles, then calculates a middle value to set buy and sell triggers. When the price crosses above the middle value (indicating bullish momentum), a buy stop order is placed. Conversely, a sell stop order is set when the price crosses below the middle value (suggesting bearish momentum).

- Risk Management: Each trade’s risk is carefully managed by setting stop losses and take profits based on predefined points. Additionally, a trailing stop mechanism is employed to protect profits by moving the stop loss to a more favorable position as the market moves in the trade’s favor.

- Martingale Approach: The strategy optionally includes a Martingale component, where the lot size is increased after a loss by a specified factor, up to a maximum number of levels. This approach aims to recover from losses by doubling down on subsequent trades but is used with caution due to the increased risk it carries.

- Automation & Monitoring: The trading system is designed to run on the MetaTrader platform, automatically setting up trades and adjusting orders as market conditions change. It monitors active positions and orders, updating them as needed to align with the current market scenario.

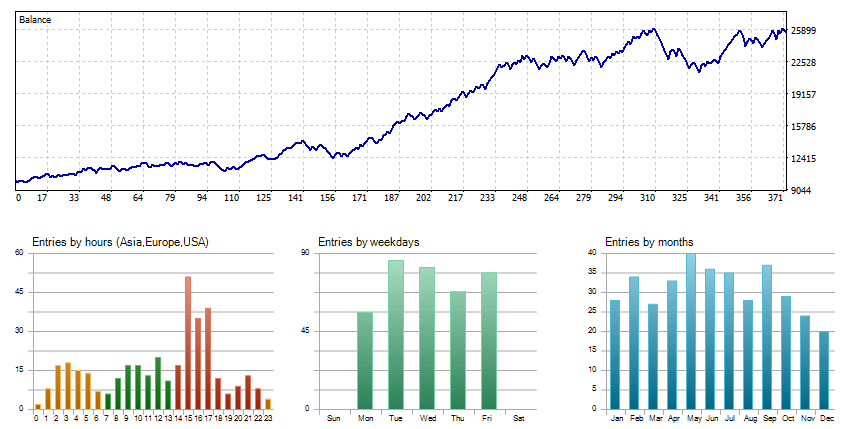

- Account Balancing: Lot sizes for new trades are calculated based on the account balance, ensuring the trading volume is proportionate to the trader’s capital. This is a crucial aspect of the strategy, as it balances the potential profit against the risk of loss.

- Adjustable Parameters: Traders can input various parameters such as lot size, lot factor for account balance, take profit points, stop loss points, trailing stop loss points, and the triggering points for trailing stops. These inputs allow customization according to individual risk tolerance and market conditions.

- Outcome Tracking: The system keeps a record of trade outcomes to adjust the Martingale level appropriately. Wins reset the Martingale level, while losses increase it, influencing the lot size of the next trade.

In essence, this strategy is a sophisticated blend of technical analysis with an advanced risk management system, designed to adapt to market movements and trader preferences. The integration of Martingale elements introduces an aggressive edge to the strategy, aimed at capitalizing on market trends while managing the potential downsides.